Van Insurance

We always need a copy of your van insurance in order to either tax your van or to keep on file if we manage your fleet for you.

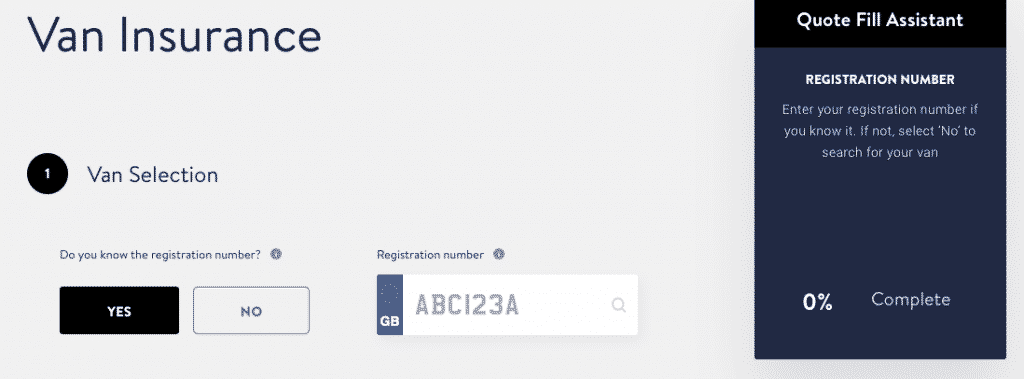

Please click below to get a comparison with most leading insurance companies in the UK. You will need your registration number. Its important to be completely transparent and open or this can be an excuse not to pay out on a claim. In many cases you are not the keep nor owner of the vehicle in which case you may need a GAP policy.

Should you need advice on GAP insurance our specialist is Ashley.

A few pointers on Van Insurance

- Sign writing your van will often reduce your premium

- Fitting a Ghost Immobilizer which we can arrange on 50% of our vans (some suppliers are too far away)

can reduce your premium. We can add this to your payments. - Fitting an approved tracker can reduce your premium. Same as above 50%. We can add this to your payments.

It MUST be approved by insurance companies not one you buy on internet. - Being able to park off the road helps too

- Look for separate tool insurance if you have to park on the street. The average tradesman has £10,000 worth of tools in their van.

- Declare anything you have bought such as alloy wheels spoilers, sidebars etc. The premium generally won’t increase but you will have greater peace of mind.

- Check the policy is new for old or you could have some serious negative equity should the vehicle be written off.

If its not new for old we sell GAP Insurance for just this very reason.

Van Insurance Price Comparison

The cost of van insurance really depends on where you live and your trade and occupation. Many of you store tools in the van so its great to have peace of mind that if the unthinkable happens then your tools and lively hood will be replaced. Here are some tips and misconceptions to help you find some cheap van insurance.

Save time and money by comparing up to 30 different cheap van insurance companies. A few details are needed ad you can dramatically reduce your premiums by getting things like a Ghost Immobilizer or a Vehicle Tracker fitted by us. Even just sign writing your van can reduce insurance as tradesmen tend to drive more carefully when they are accountable.

Bear in mind unless you are in hire purchase or lease purchase agreement then the policy is unlikely to be “new for old.” This means for example that you are in risk from negative equity on many finance agreements which is why we sell GAP insurance. This can be added to the purchase price in many cases.

e.g

This is a real life example.

A Mercedes Vito van is sold and in the first 12 months written off by a third party and no fault to the driver. This ws pre COVID.

Settlement £26,000 payout was £16,000 reduced to £12,000 as the driver had not declared the alloys.

The vehicle was on contract hire thus most policies will not payout the purchase price if it isn’t an ownership scheme. A GAP policy is the best solution and would have covered this difference.