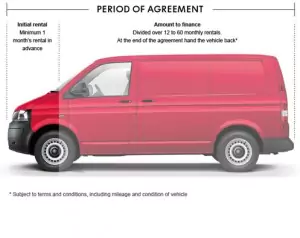

There are many benefits of leasing a van through contract hire. Some of these benefits include a low initial outlay, a pre-determined monthly rental rate, inclusive road fund licence, a flexible contract of 1 to 4 years, and the van under contract hire is not considered a company asset and therefore is an off-balance-sheet property.

There are many benefits of leasing a van through contract hire. Some of these benefits include a low initial outlay, a pre-determined monthly rental rate, inclusive road fund licence, a flexible contract of 1 to 4 years, and the van under contract hire is not considered a company asset and therefore is an off-balance-sheet property.

One of the most attractive benefits of van contract hire is the tax savings your company can make.. How so?

In most instances, the monthly payments that the leasing company pays in a span of one year are fully deducted against any taxable profits. In this instance, capital allowances (or depreciation) cannot be claimed. For vehicles with a retail price of up to £12,000, taxable profits are fully offset. For vans or any business vehicle with a retail price of more than £12,000, there is a set restriction based on the half the excess rule. The standard formula is:

Disallowed percentage of rental = 1/2 (Vehicle cost – 12,000)*100/ Vehicle Cost

The most attractive benefit of a van contract hire is that a VAT registered, leasing company has the opportunity to avoid paying 100% VAT if the vehicle under contract hire a qualifying vehicle used wholly for business and not for personal purposed. If a van under contract hire is used for both business and personal reasons, then only 50% of VAT may be recovered which is still a substantial amount on tax savings. However, VAT on the maintenance of a vehicle can be fully claimed back.

General Qualifications of VAT-exempt Vehicle

Not every vehicle can is VAT exempt. A company can claim VAT relief if their vehicle under contract hire is a qualifying vehicle used for a pertinent purpose. It is possible to recover VAT if the vehicle is:

• part of a motor manufacturer’s or dealer’s stock in trade

• used as a taxi hire or for driving instruction or self-drive hire

• used exclusively for business purposes

However, there is no way a leasing company can fully offset payments against profits if the following situations are present:

• The van under contract hire has a CO2 emission over 160g/km

• The rentals are nor spread evenly during the lease terms

• OR, the lease has a provision or clause that may eventually allow the leasing company to own the van

A leasing company that bought a vehicle on finance lease can also claim all the VAT charged if the vehicle is exclusively used for business purposes.

Here at Swiss Vans, we offer both types of van financing – finance lease and contract hire. For example you can get a Ford Transit Custom Panel Van for your company for great tax savings.

Ford Transit Contract Hire Option Examples:

Ford Transit Contract Hire Option Examples:

6 + 23 Payments of £209.21

6 + 35 Payments of £210.97

6 + 47 Payments of £202.26

Call us now for more information.

Jargon Dictionary:

APR -Annual Percentage Rate is the calculation used to benchmark the cost of loan. The lower the APR the better the APR.

Balloon Payment – Refers to the final end payment on a lease purchase or personal contract purchase. It is used to qualify for lower monthly payments as the real value of the van is not actually paid.

BIK -Or Benefit in kind is the term used by the Inland Revenue to assess a person’s tax liability on any company benefit he has, e.g. fuel allowance or car.

CO2– Refers to the emission rating (g/km) of a vehicle. The lower the rating, the “greener” the vehicle and therefore the lower the tax.

Depreciation – Refers to the de-valuation of a vehicle due to age, condition and mileage.

Disallowable/Allowable VAT – A vehicle that is acquired through contract hire or finance lease and used for personal business is entitled to only halt the VAT on the rental payment. The other half of the VAT that cannot be claimed back is the disallowable VAT.

Early Termination -Refers to the cancellation of a finance agreement before its due date.

Effective Rental – Refers to the actual cost of a rental, taking into consideration the disallowed VAT element of a contract hire or finance lease agreement.

Excess Mileage – Some finance agreements charge PPM or pence per mile when the pertaining vehicle exceeds the agreed upon mileage.

Final Payment – Refers to balloon payment.

Guaranteed Minimum Final Value – Refers to the agreed upon value in particular finance agreements. This basically means that the leasing company or person does not have to worry about residual value.

Imported Vehicles (Parallel/Grey) – Parallel imports refer to UK specification (or similar) vehicles that are imported by European countries to the UK. Grey imports are none UK model vehicles imported from other countries such as Japan.

Initial Payment/Rental -Refers to the initial payment or deposit before a vehicle is delivered.

OTR– Refers to On The Road price, which is the final invoice value of a vehicle, inclusive of road tax and delivery to the dealer. There is no OTR for contract hire agreements.

Off Balance Sheet -A vehicle that is funded by contract hire is not an asset of the leasing company and therefore does not appear on the company’s balance sheet.

P11D- Refers to the amount that the Inland Revenue use to compute the taxable benefit of the company driver.

PPM – Pence per mile refers to the excess charge on top of the agreed upon mileage in the contract.

Pooled Mileage Agreement – To save o the overall running cost, grouping the mileage of a fleet is highly advisable. This practice will offset excess mileage of cars against cars with low mileage.

Terminal Pause – Refers to a payment profile of an agreement or contract such as 3 t 33 (36 months) and 3 + 21 (24 months). These two schemes allow for a 2 month-payment free period at the end of the contract because the last two payments were paid up front.

Reduced Spread – This scheme keeps the monthly payment down to a minimum in the case of contract hire agreements. A Reduced Spread of three years would be indicated as 3+35, for a total of 38 payments instead of 35.

Residual Value – Refers to the worth of a vehicle at a pre-determined time such as at the end of a finance agreement or contract.

RFL – Stands for Road Fund Licence or road tax.

VAT Qualifying Vehicle – A vehicle purchased through contract hire by a leasing company is classified as a VAT qualifying vehicle if its only usage is as a vehicle rented out to customers. The buyer of the vehicle can claim the VAT back when he sells the van in the end. The value becomes plus VAT.